In international trade, payment terms are more than just a clause in a contract—they are a foundation for trust, clarity, and financial security between buyers and sellers across borders. Whether you’re a seasoned trader or new to the export-import business, understanding payment terms is essential for managing cash flow, mitigating risks, and ensuring the success of your global transactions.

At Emirachem, we understand the value of secure, transparent transactions. As a trusted supplier of Polyurethane, Polyols, and PVC Resins, we not only offer premium products but also ensure a smooth, efficient supply chain with flexible payment options tailored to our clients’ needs.

What Are Payment Terms in International Trade?

Payment terms define the conditions under which a seller will complete a sale. These include when the buyer is expected to pay, the methods of payment accepted, and any discounts for early payment or penalties for late payment. They are crucial for:

- Ensuring cash flow management

- Reducing the risk of non-payment

- Clarifying expectations for both parties

- Enabling smoother customs and documentation processes

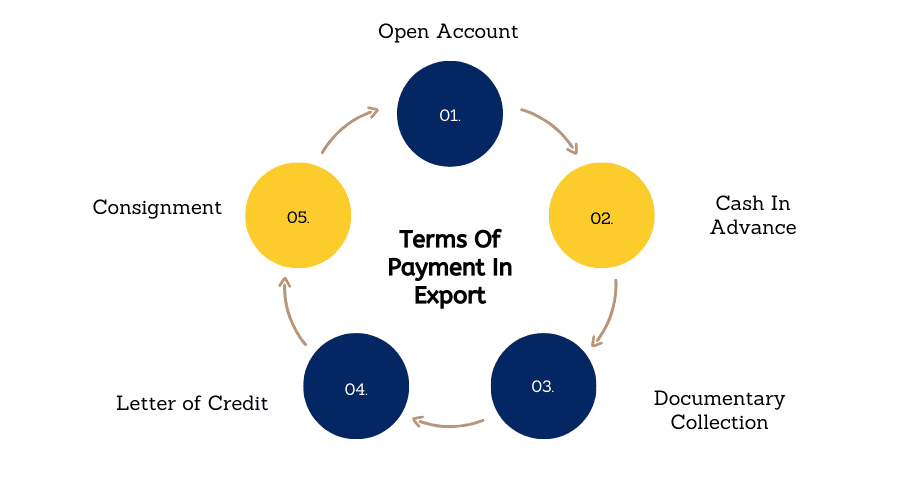

Common Types of Payment Terms in Export & Import

Let’s explore the most widely used payment methods in international trade, along with their pros, cons, and use cases in industries like chemicals and raw materials.

1. Advance Payment (Prepayment)

Description: The buyer pays the seller before goods are shipped.

Advantages:

- Safe for the exporter

- Guarantees funds before production or shipping

Disadvantages:

- Risky for the importer

- Trust required

When to Use: Ideal when the buyer has a long-standing relationship with the seller or when dealing with customized chemical orders.

📌 Emirachem provides detailed technical specifications and product assurance to give our customers peace of mind, even with advance payments.

2. Open Account

Description: Goods are shipped and delivered before payment is due (typically 30, 60, or 90 days later).

Advantages:

- Attractive to buyers; helps with cash flow

- Builds long-term trust

Disadvantages:

- High risk for sellers

- Requires credit evaluation

When to Use: Best for trusted, recurring business relationships.

3. Letter of Credit (LC)

Description: A bank guarantees the buyer’s payment to the seller under defined conditions.

Advantages:

- Protects both buyer and seller

- Ensures goods meet agreed standards

Disadvantages:

- Complex and costly to set up

- Requires accurate documentation

When to Use: Popular in large chemical trades involving bulk Polyurethane or PVC Resins where trust has yet to be established.

Read this: Letter of Credit Process in International Trade: A Complete Guide

✅ At Emirachem, we regularly work with LC agreements to ensure secure global transactions for all parties involved.

4. Documentary Collection (D/P or D/A)

Description: The exporter sends shipping documents to the importer’s bank, which releases them based on payment.

- D/P (Documents against Payment): Documents are released only after full payment.

- D/A (Documents against Acceptance): Documents are released after the importer signs a time draft promising payment at a later date.

Advantages:

- More secure than open account

- Less costly than LC

Disadvantages:

- No bank guarantee of payment

- Some risk for the exporter

5. Consignment

Description: Goods are shipped but payment is made only after the goods are sold by the importer.

Advantages:

- Encourages higher inventory at destination

- Attractive for distributors

Disadvantages:

- Very risky for the exporter

- Long payment cycles

When to Use: Suitable for niche chemicals or specialty additives.

Choosing the Right Payment Term: Key Considerations

When determining the right payment term for your chemical exports or imports, consider:

- Trust level between the buyer and seller

- Political and economic stability of the importing country

- Size of the transaction

- Shipping method and delivery timeline

- Banking relationships and fees

🧪 Emirachem offers expert guidance on selecting the right payment and shipping terms tailored to your country and business model.

Payment Terms in the Chemical Industry

The chemical industry involves bulk materials, high value, and strict safety regulations. That makes the right payment terms critical.

For example:

- Exporting bulk Polyether Polyols to Africa might require an LC at sight to ensure fast yet secure payments.

- Supplying PVC Resin to recurring clients in the Middle East could work best on Open Account with 30-day terms.

🎯 At Emirachem, we tailor payment terms that align with our clients’ procurement cycles while maintaining risk-free delivery of premium-grade products.

Emirachem: Your Trusted Partner in Global Chemical Supply

At Emirachem, we go beyond just supplying high-quality Polyurethane, Polyols, PVC Resins, and Silicone Surfactants. We also:

- Provide flexible payment options that suit your business

- Work with reliable shipping partners for timely delivery

- Guide you through LC documentation and customs processes

- Ensure full product traceability and quality control

📞 Contact Emirachem today to explore tailored trade solutions and ensure a smooth supply chain experience for all your chemical needs.

Conclusion

Understanding international payment terms is essential for building strong trade relationships and ensuring safe and timely transactions. From Letters of Credit to Open Accounts, each method offers unique benefits depending on the business context.

When it comes to trading in chemicals, you need a partner who understands both the products and the process. Emirachem stands by your side with top-quality Polyurethane and PVC Resins, paired with unmatched logistics support and payment flexibility.